Reading the commitment

What is the Commitment for Title Insurance?

The Commitment for Title Insurance is often referred to by different names, such as the “title report,” “PR” or “prelim” (preliminary report), or simply “the commitment.” In short, the commitment is a title company’s offer to issue a policy of title insurance. Upon issuing a commitment, the title company becomes obligated to issue a policy to a proposed insured according to the terms, provisions and conditions of that commitment.

Commitments for Title Insurance are most often provided as part of either a sale or refinance transaction, but may also be issued to an individual desiring a new policy of title insurance at any time.

The commitment is made up of many different parts, but there are three main sections that contain the most relevant information:

1. Schedule A outlines key identifiers.

2. Schedule B, Part I states requirements that must be met in order for a policy to be issued.

3. Schedule B, Part II lists the exceptions to policy coverage.

Although each of these sections is very important to know and understand, Schedule B, Part II is arguably the most important section to be familiar with, as it contains information regarding potential exceptions to policy coverage. These exceptions can negatively impact the title to the property, and (in a standard transaction) must be dealt with prior to closing of a transaction/issuance of a title insurance policy.

Below are some examples* of these sections, as well as more details about each.

*Fabricated example only, not from an actual transaction.

Schedule A

This section outlines the key identifying details relevant to the policy to potentially be issued.

General information about the transaction can be found on this page, such as our file number and the street address of the property. The pieces of information that are most relevant to the issuance of a policy, and as such most important, are as follows:

1. The Commitment Date: Before a commitment is issued, a diligent search of public records is performed. This search includes examination of records such as documents recorded with the county in which the subject property is located, as well as applicable judgments and/or bankruptcies associated with any of the names currently on/to be listed on title. The Commitment Date is essentially a “good thru” date, a date and time up to which the search has been performed.

2. Policy to be issued: This section shows the type of policy that will be issued under the terms of the commitment, as well as the proposed policy coverage amount and the cost of the premium for the policy. We generally issue one of four policies, depending on the transaction, the subject property, and our role within said transaction: the Standard Homeowner’s Policy, the Eagle (expanded coverage) Homeowner’s Policy, the Standard Loan Policy, and the Eagle (expanded coverage) Loan Policy. These policy types are explained in more detail in our “Policy Types” Title Tip.

3. Estate or Interest type of the subject or property. In our area, most transactions will involve a “Fee Simple” interest, which means that the property is owned permanently and can be sold at the landowner’s disclosure. This is the most common type of landownership.

4. Vesting of title: This is simply the name by which a landowner holds the title to property. This must read exactly as appears on the current vesting deed (the most recent transfer deed to be recorded with the county), regardless of accuracy/correctness. The only way this can be changed is by recording a new transfer deed.

5. Legal description: The legal description is just that – the legal description of the boundaries of the subject property. Please note that this is not the same as the property address. On some of our commitments, a reference is made to the attached “Exhibit ‘A’” which contains the description and can be found towards the end of the commitment.

Schedule B, Part I

A very standardized and straightforward section, Schedule B, Part I lists the requirements that must be met in order for a policy to be issued. Although very general in nature, these requirements are important to understand.

This section rarely changes, however there are instances in which there will be additional requirements, such as the following that are included when handling a transaction involving new construction:

As such, we advise to make a habit of looking at this section for each transaction.

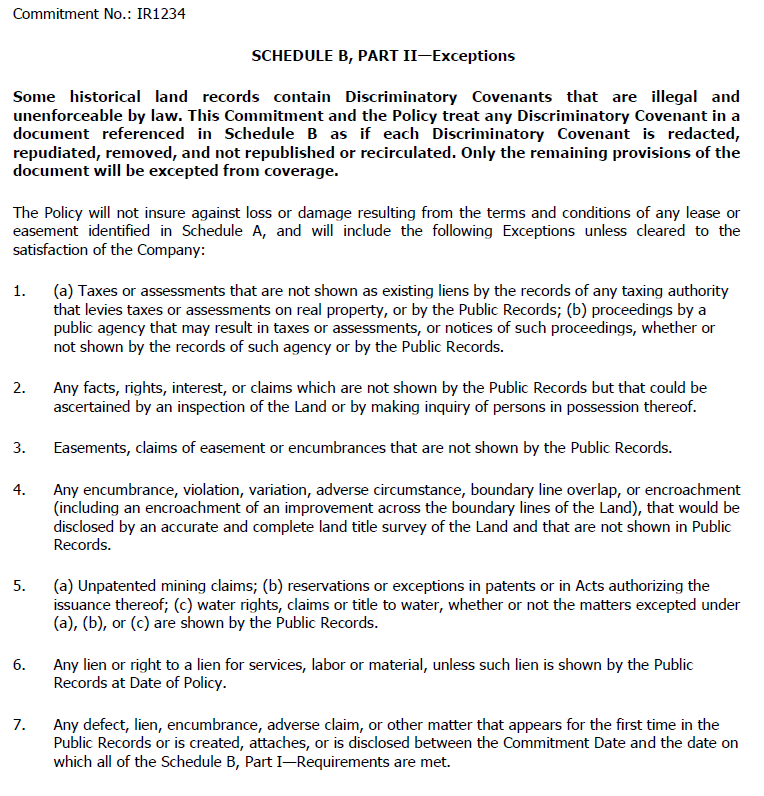

Schedule B, Part II

Schedule B, Part II lists exceptions to policy coverage. As stated previously, it is very important to have at least a general understanding of this section, as it discloses matters that the insurance policy doesn’t cover and that have, or can have, an impact on the title. This section can be looked at as two parts, which is made easy because of natural page break in the commitment.

The first section, the first page of Schedule B, Part II, is comprised of general exceptions that will apply to all properties.

Like the Requirements found in Schedule B, Part I, these Exceptions will appear on every commitment that is issued. Similarly, although these will be the same, it can help to have a basic understanding of these items.

The second section, found on any subsequent pages, are (mostly) property/transaction specific, and therefore will be important to be familiar with for each and every transaction. Here are examples of common exceptions that apply to most transactions:

These exceptions originate from documents, related either to the property, landowner, or proposed buyer, that are found during the examination process.

8. Taxes: Property taxes affect every property in some way, and are handled differently depending on the transaction and time of year. Unpaid taxes can result in a loss of the property to the County, and therefore it is important to know whether taxes have been paid, as well as assessed tax amounts. In sale transactions, taxes will be prorated, each party being held responsible for the amount of time they owned the property during the year transaction took place.

9. Charges: a simple exception that discloses the general tax district of the property. If the property falls within a special improvement, assessment or tax district, that will also be shown under this exception. While specifics are not entirely necessary, as these charges are generally paid with the county property tax, more details about the tax district can be provided upon request.

10. & 11. Easements: an easement is a recorded right to use a specified portion of a property. While an easement doesn’t grant an ownership interest in the property, it is a legal grant of permission that cannot be denied unless the easement is released/removed. That being said, easements are usually granted to only to certain parties for specific uses, such as the owner of an adjacent property for the sole purpose of accessing their property. General easements can often be found on the plat map, while more specific easements are generally found on county records.

12. Minerals: We do not handle transactions involving mineral rights, nor do we perform searches of public record for mineral rights. As such, this is a standard exception that will be found on nearly all commitments.

13. Covenants, Conditions & Restrictions: Referred to most often as CC&Rs, these documents disclose any terms and provisions related to the specific area within which the subject property is situated. These are most often found to affect properties within established subdivisions or Planned Unit Developments (PUD, essentially the same meaning as “established Subdivision), especially those managed by Homeowners’ Associations (HOAs).

14. Deeds of Trust: A Deed of Trust is the security instrument used in Utah that is recorded with the county in order to secure payment of a home loan. A deed of trust is a form of voluntary lien, or a lien (a legal claim against the title to property that can be used as collateral to repay a debt) that is agreed to and initiated by the property owner.

15. Any Lien or Right to Lien: This exception addressed any potential right to lien or encumber the property that is not found on public record, and is generally found as Exception 6. In transactions involving new construction we will also include it later on in the list as well. To be very direct, this exception acts as an indemnity for the title company, as there’s no way we can address issues that we aren’t able to find or that weren’t brought to our attention.

These are but a few of the types of exceptions that may appear on the commitment. Others include tax liens, judgments, bankruptcies, State Construction Registry filings, issues with physical/legal access, and issues with past title transfers.

It is crucial to understand how each aspect of the commitment can affect your subject property. If you ever have any questions about any items on your commitment, please reach out to your title company!!!